Calculating payroll taxes 2023

Subtract 12900 for Married otherwise. 2022 Federal income tax withholding calculation.

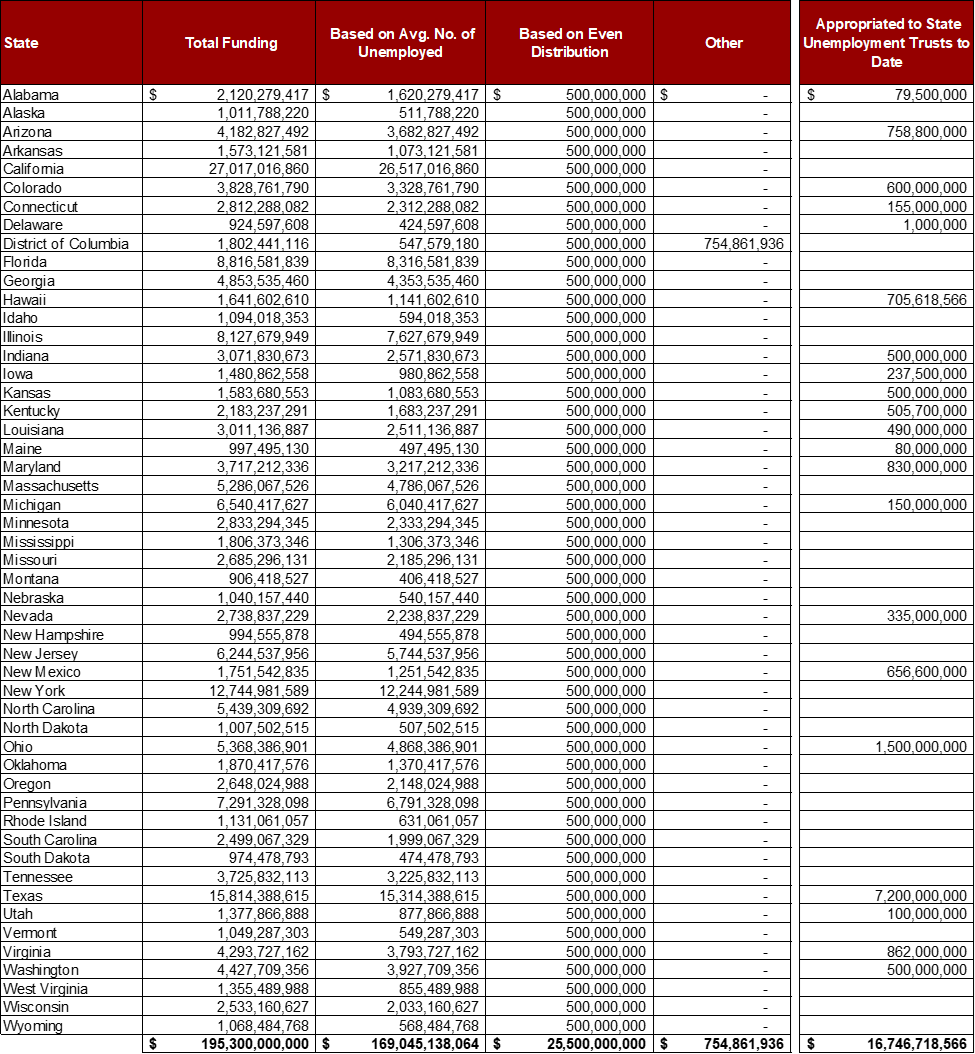

Social Security Changes That May Be Coming For 2023 Gobankingrates

The annual threshold is adjusted if you are not an employer for a.

. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. We speak your language. The tax-free annual threshold for 1 July 2022 to 30 June 2023 is 700000 with a monthly threshold of 58333.

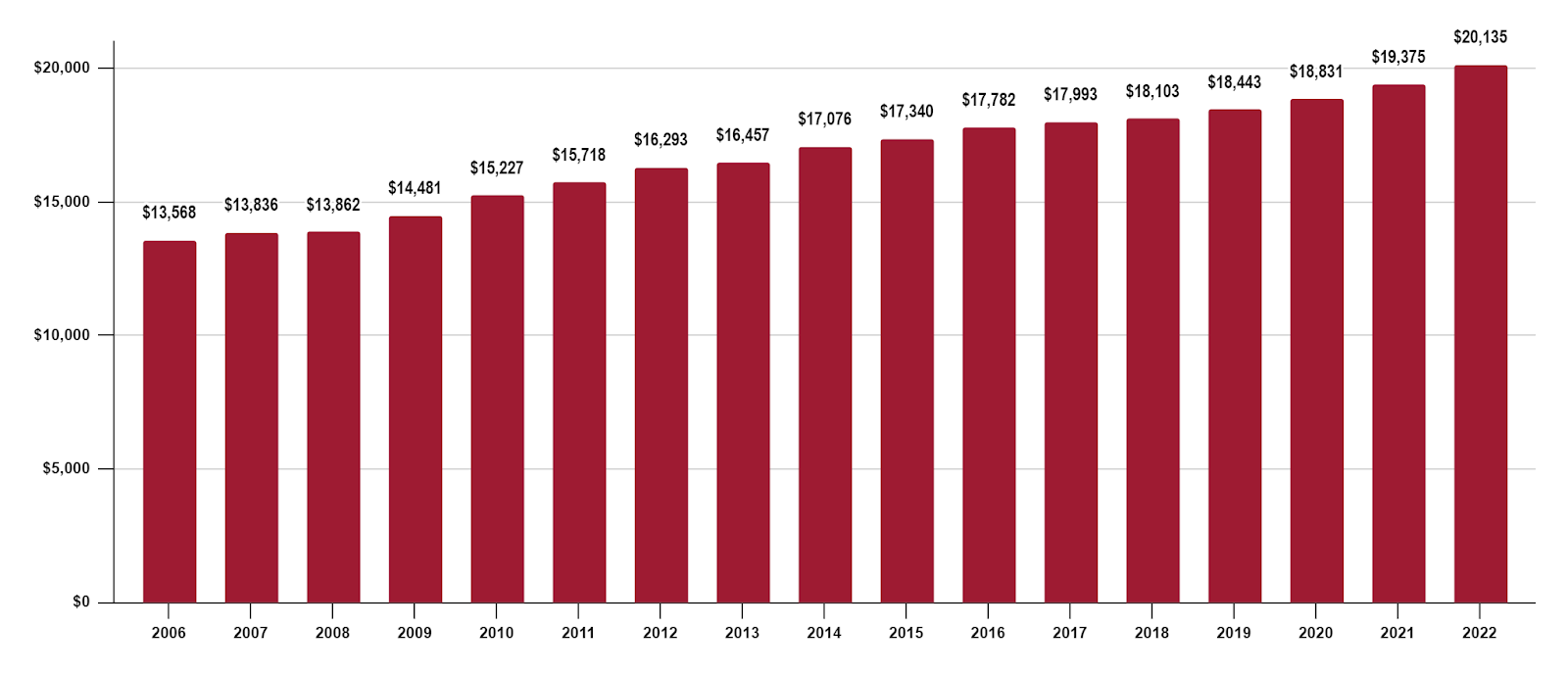

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Here are the provisions set to affect payroll taxes in 2023. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an.

Clients In 50 Countries. For married individuals filing joint returns and surviving spouses. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Increase the payroll tax rate to 161 up from the current 124 with no changes in the taxable income. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan. Well calculate the difference on what you owe and what youve paid.

Ad Process Payroll Faster Easier With ADP Payroll. If youve already paid more than what you will owe in taxes youll likely receive a refund. The standard FUTA tax rate is 6 so your max.

Try out the take-home calculator choose the 202223 tax year and see how it affects. Household Payroll And Nanny Taxes Done Easy. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

The payroll tax rate reverted to 545 on 1 July 2022. The payroll tax rate reverted to 545 on 1 July 2022. Get your free demo today.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Get Free Payroll For 2 Months. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to. Designed for small businesses to make payroll Easier and simple. Ad Process Payroll Faster Easier With ADP Payroll.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Access To Unlimited Payrolls Automatic Tax Payments. Tax is calculated on a gradual diminishing tax-free threshold that gradually phases out between the annual threshold of 1000000 and.

The tax is 10 of. This Tax Return and Refund Estimator is currently based on 2022 tax tables. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Ad Compare This Years Top 5 Free Payroll Software. If taxable income is under 22000.

Discover ADP Payroll Benefits Insurance Time Talent HR More. This Tax Return and Refund Estimator is currently based on 2022 tax tables. The marginal tax rate is the rate of tax that employees incur on.

The payroll tax rate reverted to 545 on 1 July 2022. PAYE tax rates and thresholds 2022 to 2023. 2022 Federal income tax withholding calculation.

Ad Aprio know the languages cultures and business climates of where you do business. Ad Run payroll in one click via one powerful dashboard. Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations.

2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free. The tax rate schedules for 2023 will be as follows. Prepare and e-File your.

This Tax Calculator will be updated during 2022 and. Free Unbiased Reviews Top Picks. Subtract 12900 for Married otherwise.

242 per week 1048. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022. Get Started With ADP Payroll.

Over 8000 companies use Deel to help them hire employees all over the world. In case you got any Tax Questions. See your tax refund estimate.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to. Cross New Borders With Confidence. Get Started With ADP Payroll.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. It will be updated with 2023 tax year data as soon the data is available from the IRS. Ad Payroll Software Made for Small Businesses.

Well Do The Work For You. Employee portion calculators can be found under Resources on this page. Payroll Tax Employer Guide.

Prepare and e-File your. Payroll calculator 2023 Senin 19 September 2022 Edit. Unemployment insurance FUTA 6 of an.

View All Hr Employment Solutions Blogs Workforce Wise Blog

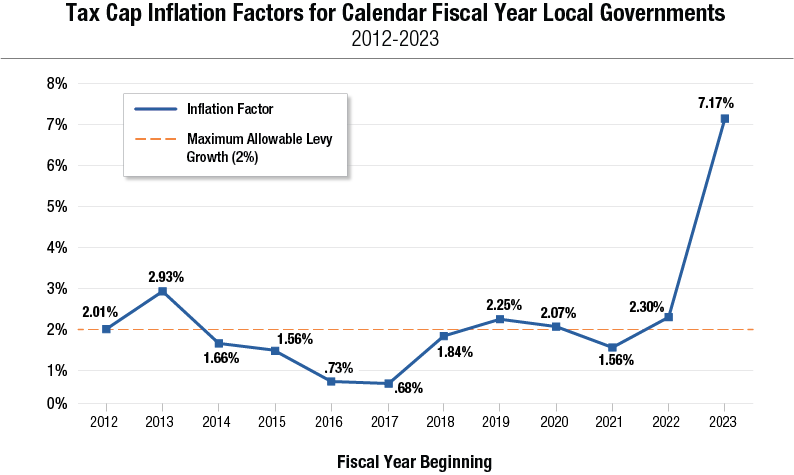

Dinapoli Tax Cap Set At 2 In 2023 Office Of The New York State Comptroller

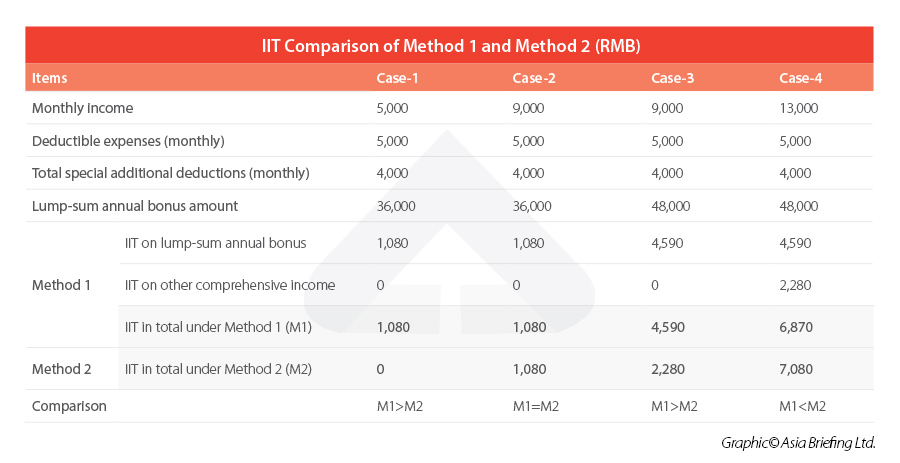

China Annual One Off Bonus What Is The Income Tax Policy Change

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

C2fko6meji F6m

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

C2fko6meji F6m

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Sharing My Tax Calculator For Ph R Phinvest

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

2

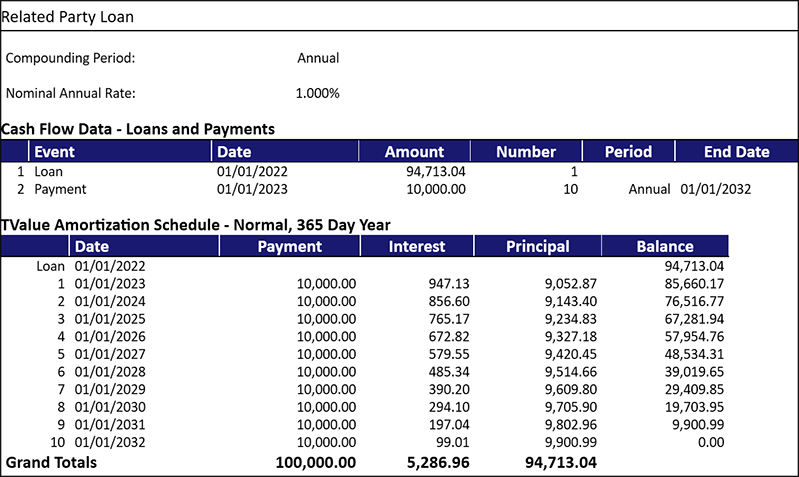

Calculating Imputed Interest For Related Party Loans Timevalue Software

C2fko6meji F6m

China Annual One Off Bonus What Is The Income Tax Policy Change